There was all-round cheer for the economy on Tuesday as industrial output growth rebounded in February, retail inflation eased in March triggering hopes of an interest rate cut and the weather office predicted above average-monsoon rains.

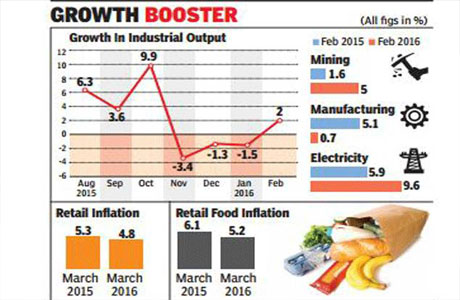

Data released by the Central Statistics Office (CSO) showed the index of industrial production rose an annual 2% in February after three months of contraction, led by robust electricity and mining sectors and growing strength in consumer durables.

Separate data released by the CSO showed retail inflation rose an annual 4.8% in March, slower than 5.3% in February, on the back of moderation in food prices.

The two sets of data came on a day when the weather office predicted above-average monsoon rains in the July-September period, bringing relief for policy makers, who are struggling to ease the pain of the farm sector, which had faced two

successive years of patchy monsoon rains. The expected revival in rural demand augurs well for overall economic growth and for easing price pressures particularly food inflation.

"Industrial growth in February mildly overshot our expectations, breaking the spell of contraction for three consecutive months and shrugging off concerns related to loss of man-days following disruption in parts of Haryana in that month," said Aditi Nayar, economist at ratings agency ICRA.

"The turnaround to a growth of 2% in February from contraction in the previous month, was broad-based, with an improved performance of all the sub-sectors except consumer non-durables.

The higher growth of consumer durables despite a somewhat adverse base effect, the year-on-year rise in manufacturing output after three months of contraction as well as the fewer number of its sub-sectors witnessing de-growth in February 2016 are encouraging trends," Nayar said, adding that the IMD's forecast of an above-normal monsoon has boosted the outlook for rural demand, which should help arrest the sustained contraction in consumer non-durables over the coming months.

Economists expect retail inflation to be around 5% in the current fiscal and within the central bank's comfort zone. "Maintenance of inflation at this level could be another trigger for RBI to take action on interest rates during the course of the year," said Madan Sabnavis, chief economist at ratings agency CARE.

The central bank reduced rate in its policy review earlier this month by 25 basis points. It has said that it will continue to watch macroeconomic and financial developments in the months ahead with a view to responding with further policy action.

The Indian economy is expected to grow by 7.6% in the current finnacial year and remains the fastest growing major economy in the world.

Add Comment