Tanzania's National Budget has received praise from the Institute of Chartered Accountants of India (ICAI), which asserts that it has a potential to fortify the Nation's economy and encourage investments. During a Continuing Professional Education (CPE) programme that was sponsored by the organisation, the ICAI branch in Dar es Salaam voiced its points of view. At the occasion, accountants and financial experts convened to discuss and evaluate significant tax and budget developments in Tanzania. The evaluation of macroeconomic data, the collection of excise and value-added taxes, and the reduction of the Skills and Development Levy (SDL) rate were amongst the topics covered.

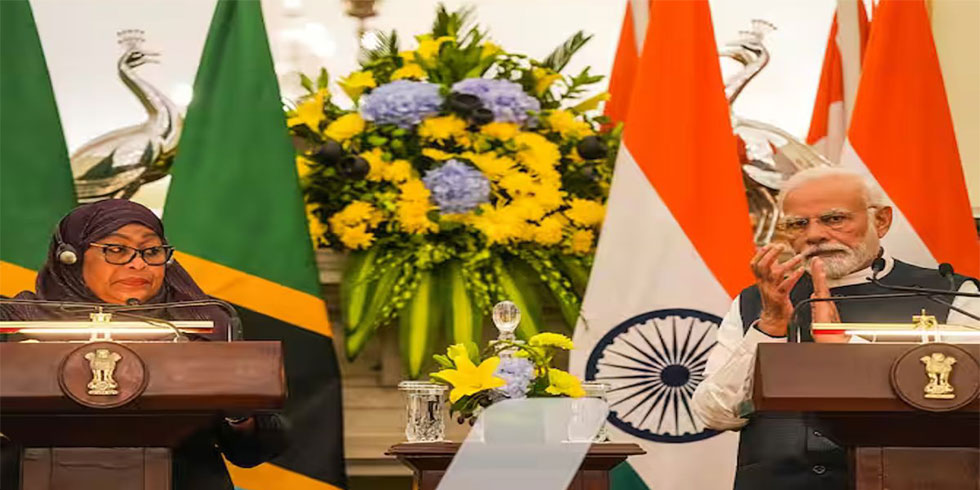

According to Mr. Narender Kumar, Second Secretary (Commerce) in the Office of the Indian High Commissioner, The budget intends to promote national growth by enhancing investment opportunities and creating a more efficient single-window licencing system. As a result, mining businesses may face additional expenses.. A further expense for mining firms is not permitting royalty payments for mineral royalties to be considered expenses.

Mr. Dharmendra Agrawal, a participant, claimed that budget changes and a lower rate of the Skills and Development Levy (SDL) would minimise employment costs. According to Section 14 of the Vocation Education and Training Act, Cap. 82, SDL is a tax that must be collected by the Tanzania Revenue Authority (TRA). In accordance with the modifications made to the Finance Act of 2023, theThe SDL rate has been trimmed from 4% to 3.5%.The Sh44.39 trillion national budget was adopted by the National Assembly in June 2023, an increase from the Sh41 trillion budget for the fiscal year 2022–2023. As a clear sign that the government was becoming more investor-friendly and eager to support businesses, Finance Minister Dr. Mwigulu Nchemba proposed an exemption of the VAT on the supply of precious metals, gemstones, and other precious stones at buying locations, mineral markets, and Gem houses designated by the Mining Commission under the Mining Act or refinery located in Mainland Tanzania.

In order to include locally manufactured capital goods to the list of capital goods that are eligible for deferral, the government has proposed amending Section 11 of the VAT Act. In an effort to relieve the local producers of pharmaceutical packaging and enhance their competitiveness in the market, Dr. Nchemba also suggested altering the VAT Act, CAP 148 to eliminate the inputs required for producing packaging materials. A one-year period of 0% rate VAT on locally produced fertiliser and textiles created with domestically grown cotton was also proposed by the minister.

Add Comment