The potential to expand bilateral trade remains enormous as India and Africa consider the potential of a comprehensive trade and investment agreements, but negotiators face significant obstacles in their quest for a win-win outcome, trade sources and analysts told FE.

The complimentary element of the trade relationship between India and Africa, according to official sources, is obvious. While it exports largely completed commodities to the continent, India buys vast quantities of inputs and intermediate items from Africa. Indian businesses have the opportunity to engage in Africa, particularly in the commodities industry. Also crucial are the strategic ties between India and Africa, where China has already solidified its influence.

In addition, negotiations with the African Union present difficulties because many of its members are still in impoverishment and may not have shared goals in a number of trade-related areas, according to some observers. Indian negotiators will have a challenging time because of the substantial intra-regional inequality within the African Union.

African countries established the African Continental Free Trade Area (AfCFTA) in 2021 with the aim of expanding intra-African trade and creating a single African market for the free movement of commodities, services, labour, and money. According to Tanu M. Goyal, senior fellow at ICRIER, "AfCFTA may be able to provide Indian enterprises and investors significant chances to access into a bigger, united, and powerful African market." The AfCFTA's own secretariat is located in Accra, and it would probably be important in discussions with India on any trade or investment deal.

The removal of tariffs on 90% of commodities under the AfCFTA is anticipated to increase intra-regional business from 16% of all trade in Africa to 52% in the next five years, according to David Sinate, chief general manager (Research & Analysis) at Exim Bank. Therefore, this would be the ideal time to act and include India's commitments in Africa. The AfCFTA reform is anticipated to have the most positive impact on the manufacturing subsectors of textile, clothing, leather, wood, paper, vehicle and transport equipment, electronics, and metals, according to Sinate.

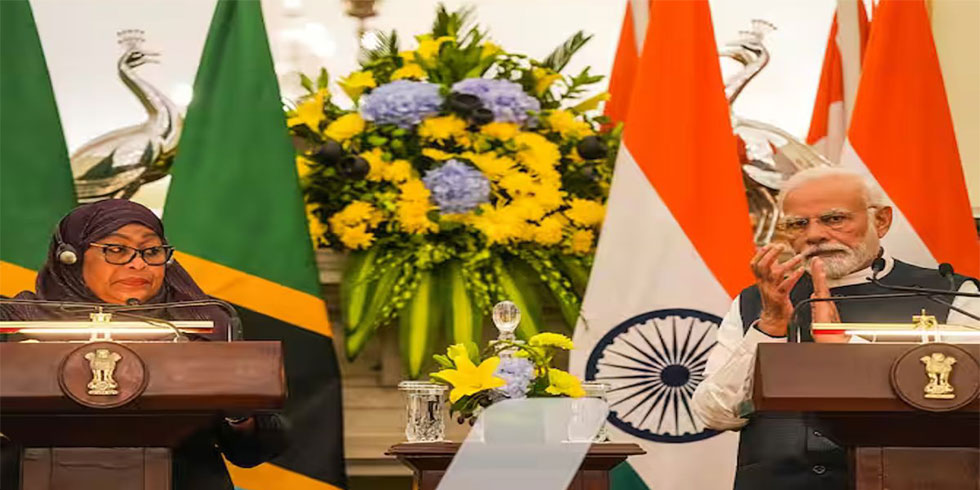

The intention to create a trade agreement with Africa was emphasised by commerce and industry minister Piyush Goyal when he spoke at a conference on the India-Africa Growth Partnership last month. Here is because, in the long run, "both India and Africa's economic future is going to be optimistic, since this is where the markets and possibilities are available," the speaker stated.

According to ICRIER's Goyal, Indian companies invested approximately USD 23.3 billion in Africa between January 2015 and May 2021. The major receivers of FDI from India in Africa are the financial, telecommunications, and mining industries. ONGC Videsh, Bharti Airtel, Vedanta, Shapoorji Pallonji Infrastructure Capital Company, GMR Infrastructure, and Sun Pharmaceutical Industries are a few of the major Indian investments in Africa.

By integrating India into global value chains and promoting commercial links with several African nations, the AfCFTA is therefore expected to open doors for India with Africa, according to the expert. However, she continued, 'generally speaking, Africa has three impediments: access to capital, language and culture barriers, and infrastructure delays.'

The increasing interest in Africa comes with New Delhi's efforts to expand trade with relatively small and medium-sized countries as important markets like the US and the EU face a significant slowdown in growth. African countries will also greatly benefit from this interaction because, direct contrast to what an official source had earlier claimed in a covert allusion to China, which has frequently been accused of engaging in unfair trade and investment practises, India's trade and investments on the continent are not intended to trap the nations in a "debt trap."

Add Comment