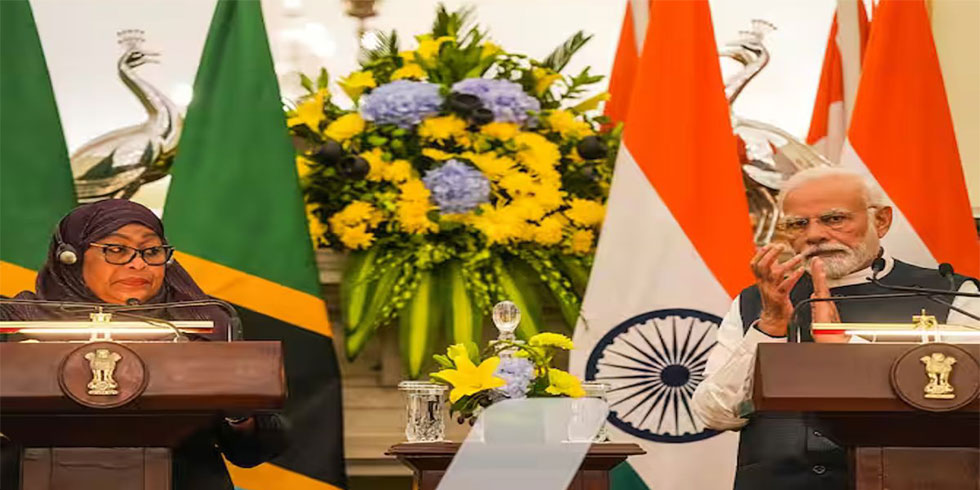

The governments in Africa and India are increasingly strengthening their ties as both parties seek mutually beneficial partnerships largely through trade. Prime Minister Narendra Modi recently noted that the current India-Africa partnership includes implementation of 180 lines of credit worth USD11bn in over 40 Africa countries and USD 600 million in grant assistance.

India’s trade with Africa today is over $62 billion with plans to increase this volume further by boosting asso

Officials in India says that the government has taken a long-term view of its engagement with African countries by participating in existing institutions in order to support the continent’s drive to build itself from within. One such example is the Government of India’s decision to invest USD10 million in the African Trade Insurance Agency (ATI).

The shareholding makes India the first non-African government to become a member of the pan-African and multilateral investment and credit insurer with the expected outcome of boosting India’s trade relations with Africa.

The Indian shareholding in ATI will be represented by the Export Credit Guarantee Corporation of India (ECGC)

ECGC has about $99 billion in exposures and insures 32 per cent of India’s exports. Also the company has had operations in Africa since the 1960s with plans to further deepen its engagement in Africa.

“India’s membership in ATI is a landmark development for a symbiotic relationship between the two fastest growing regions in the world. It is indeed a proud moment to be the first non-African state shareholder of ATI. This partnership will not only give a fillip to the bilateral trade but also will contribute towards development of projects and enhance capacities and skills,” noted Geetha Muralidhar, Chairman and Managing Director.

The partnership is expected to help ECGC leverage its capacity to support even greater volumes of Indian exports into Africa while at the same time boost investment in ATI enabling it to provide much needed growth stream to the continent.

For most African countries regulations bind lenders and prevent them from lending significant amounts to sub-investment grade sovereigns. Institutions like ATI can offer investment insurance that can help mitigate the risks, thereby bring added lending and investment capacity to African markets.

“We are delighted to welcome the Government of India to the ATI family. This is a historic initiative that is also important because it underscores the possibilities of South-South cooperation and for developing regions to partner more with each other – drawing on natural synergies to further each other’s development objectives,” commented George Otieno, ATI’s Chief Executive Officer.

Add Comment