The $1.2 billion LNJ Bhilwara Group, a well-known brand in Rajasthan known for its textiles and garments, intends to diversify into the Indian market for electric vehicles in an effort to establish itself as a supplier to the several businesses that have sprung up in the sector.

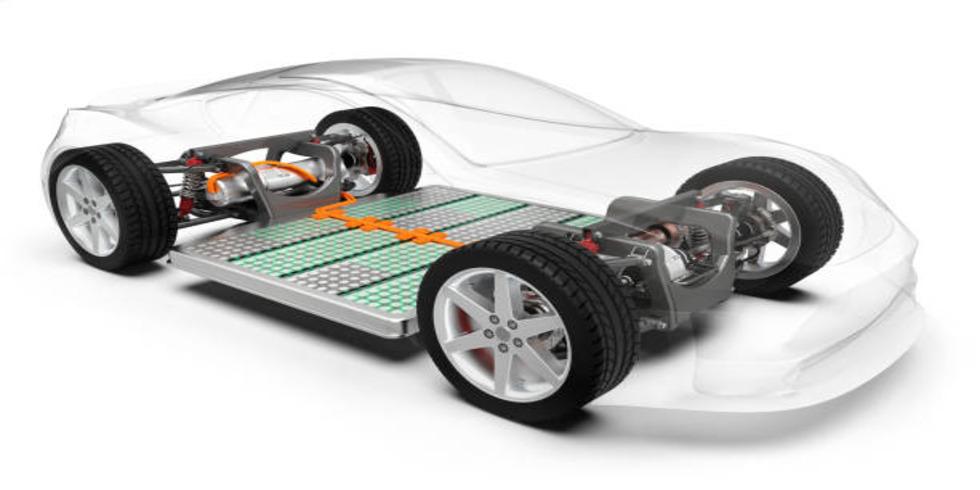

LNJ Bhilwara Group of Rajasthan has been enticed by the potential expansion of electric vehicles in India and is placing a significant wager on EV batteries, which it believes would be the group's future growth engine.

The LNJ Bhilwara Group's vice chairman, Riju Jhunjhunwala, stated, We are aware of the changing times. Technology, electric vehicles, and artificial intelligence are poised to increase significantly over the next 10 to 15 years.

Even though India's electric car ecosystem is still in its infancy, businesses like Bhilwara Group, which operate in numerous, sometimes unrelated industries, are starting to take notice of it. The two main applications for lithium ion batteries are in electric vehicles and stationary storage equipment like solar lights or rooftop panels. These batteries are produced in the nation in about 16 GWh, with about 10 GWh going to electric vehicles. This is predicted to increase to at least 500 GWh by 2030, of which 350 GWh will come from EVs.

According to Hiren Pravin Shah, executive director and CEO of the LNJ-Bhilwara Replus Venture, batteries will be the backbone and the majority of the power generation would come from solar and wind as the grid in India cleans itself and moves away from thermal power stations. Regarding EVs, the industry will mature, sales will increase, and the battery range will settle at at least 300 kilometres under real-world driving circumstances in the ensuing 3–4 years. Therefore, EV sales would represent roughly 3-3.5 gigawatt hours of our total sales, with the remaining 1.5 GWh of capacity being accounted for by stationary storage.

By 2025–2026, the automobile industry will control half of the potential revenue from EVs, with the remaining potential revenue being split among financers, insurers, and shared mobility platforms. Additionally, it will serve not only all electric vehicles—two, three, and four wheelers—but also renewable energy enterprises in need of stationary solutions as a supplier to the mainstream automobile industry. According to Jhunjhunwala, this new venture should become the group's fourth pillar and provide at least a quarter of its revenue.

In the next 5-7 years, we would like 20% to come from this specific business because if not, it would never be in focus. We must approach this as a serious matter, added he. In order for any large companies to develop a technology, we are truly working to have the most dynamic, cutting-edge systems integrator. We'll keep an eye on the major players, and if they need to transition from a certain technology, we should be able to accomplish it as quickly and inexpensively as feasible.

When we talk about cost today, our cost is based upon the price of imported cells from China, but tomorrow, when the Indian cell manufacturing starts in two to three years, one truly has to examine how competitive the Indian cell manufacturers are in comparison to the Chinese ones, he continued.

With over 250 startups competing for space, the domestic EV market is already very congested. The pie will grow as the transition away from combustion engines gains momentum, but even then it won't be able to sustain as many businesses. Some will undoubtedly pass away during a consolidation phase that might start in 2025.

It is also interested in international markets including South East Asia, the Middle East, and Africa in order to protect itself from the whims of the domestic market. Because we aspire to be a global multinational firm, Shah stated, We are not limited or restricting ourselves to the Indian market. And by virtue of that, we would investigate other areas.

Add Comment